Gifts That Pay Income

Gift annuity rate increased in January 2023. If you have ever considered a gift annuity, or already have an annuity and are interested in another, we can now offer you an even more generous annuity payment.

For most gift annuities, the new rates are 0.6% – 0.7% higher than the rates they replace in 2022. If you defer the start of payments for a year or more, the rate increase is even greater.

The combination of higher annuity rates and substantial deductions make gift annuities even more attractive if you are seeking to make a gift and receive fixed payments for life.

A charitable gift annuity is ideal if you would like to make a meaningful gift to Navian Hawaii and receive an immediate income tax deduction and guaranteed fixed payments for life.

You may choose when you want your gift annuity payments to begin. Most people choose immediate payments. However, if you don’t need the income now, you may defer your payment start date to a future time of your choosing. Generally, the older you are when payments start, the higher your payments will be.

A gift annuity can be a great way to supplement retirement income. You might also think about funding a gift annuity for another person, perhaps an aging parent or for siblings who are struggling financially. Once those receiving income have passed, the remainder of your gift will be available for use by Navian Hawaii.

The minimum age is 60 years old and the minimum gift amount is $5,000.

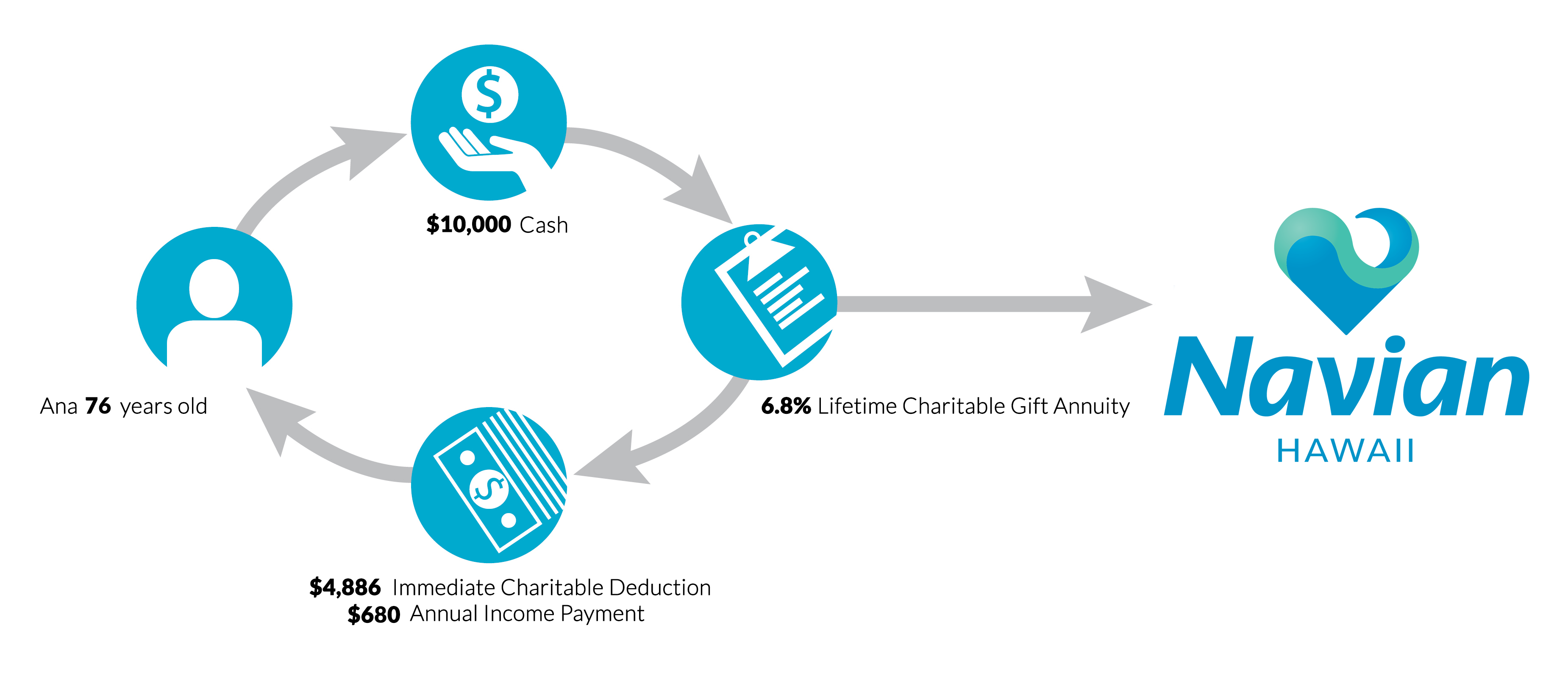

Example: Ana, age 76, contributes $10,000 cash and receives a lifetime annuity of $680, of which $433 is tax-free for approximately the first 12 years. Also, her income tax deduction of $4,886 results in income tax savings.

A charitable remainder trust is ideal if you have appreciated assets such as stocks or real estate and want payments for life or a term of years and want to support Navian Hawaii. You’ll receive an immediate income tax deduction for a portion of your gift and avoid capital gains tax.

Like a charitable gift annuity, a charitable remainder trust will pay income to you and/or to others you choose. You may either receive a fixed amount or percentage of the value of the trust each year for a set period not to exceed 20 years. When the trust terminates, the assets remaining in the trust will come to Navian Hawaii. Charitable trusts can be structured to meet your financial needs.

To see how these gifts would work in your situation or to request a personalized illustration, please contact us at (808) 924-9255 or email development@

“The care my mother received from Navian Hawaii was truly amazing. Our family couldn’t have wished for better support during that difficult time.”

Dorothy Tamura

In appreciation for the care her mother received, Dorothy established a charitable gift annuity. This allowed her to receive a significant charitable gift deduction as well as to receive regular payments throughout her lifetime.